HISTORY

ANALOGY WITH 90s DOTCOM STARTUP

back in the late 90s, people got really excited about a new thing the dot-com startups

today we're at the precipice of a new trend it's very similar and just gonna be just as impactful if not more - the crypto startup

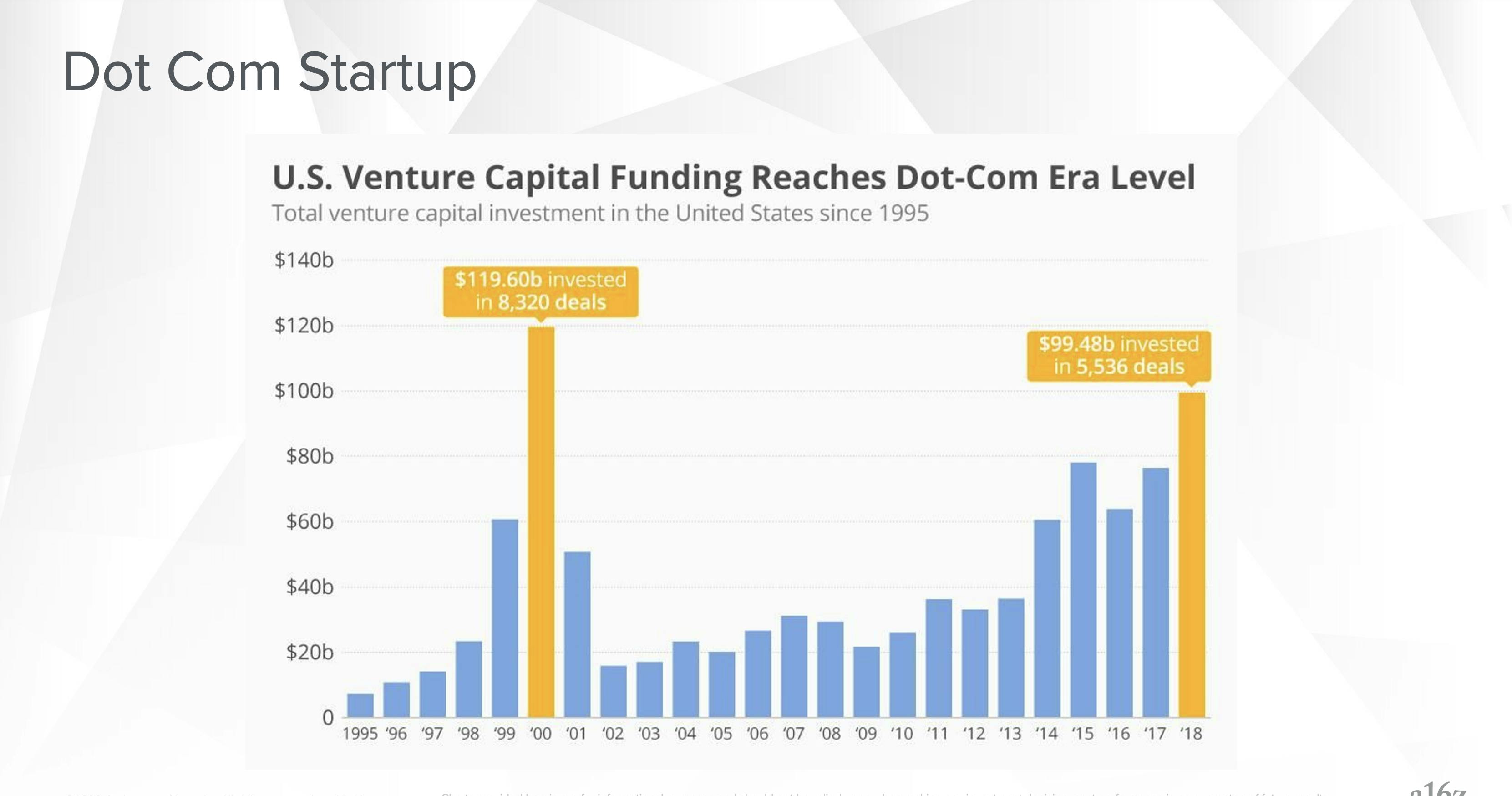

ANALYZING 90s DOTCOM BOOM

look back at the late 90s when the internet was just booming

there was this surge of investment activity which resulted in this big dot-com boom and eventually, busted.

Over the coming 20 years, many of the top most valuable companies in the world today came out of that era like Amazon Facebook and Google.

Now, we're at the very beginning of a similar phase for a new type of startup called a crypto startup.

BASED ON DECENTRALISATION

instead of being based on another global centralized protocol ( tcp/ip ) which was good for sharing information globally.

it's going to be based on a new decentralized global protocol for sharing value instead of information.

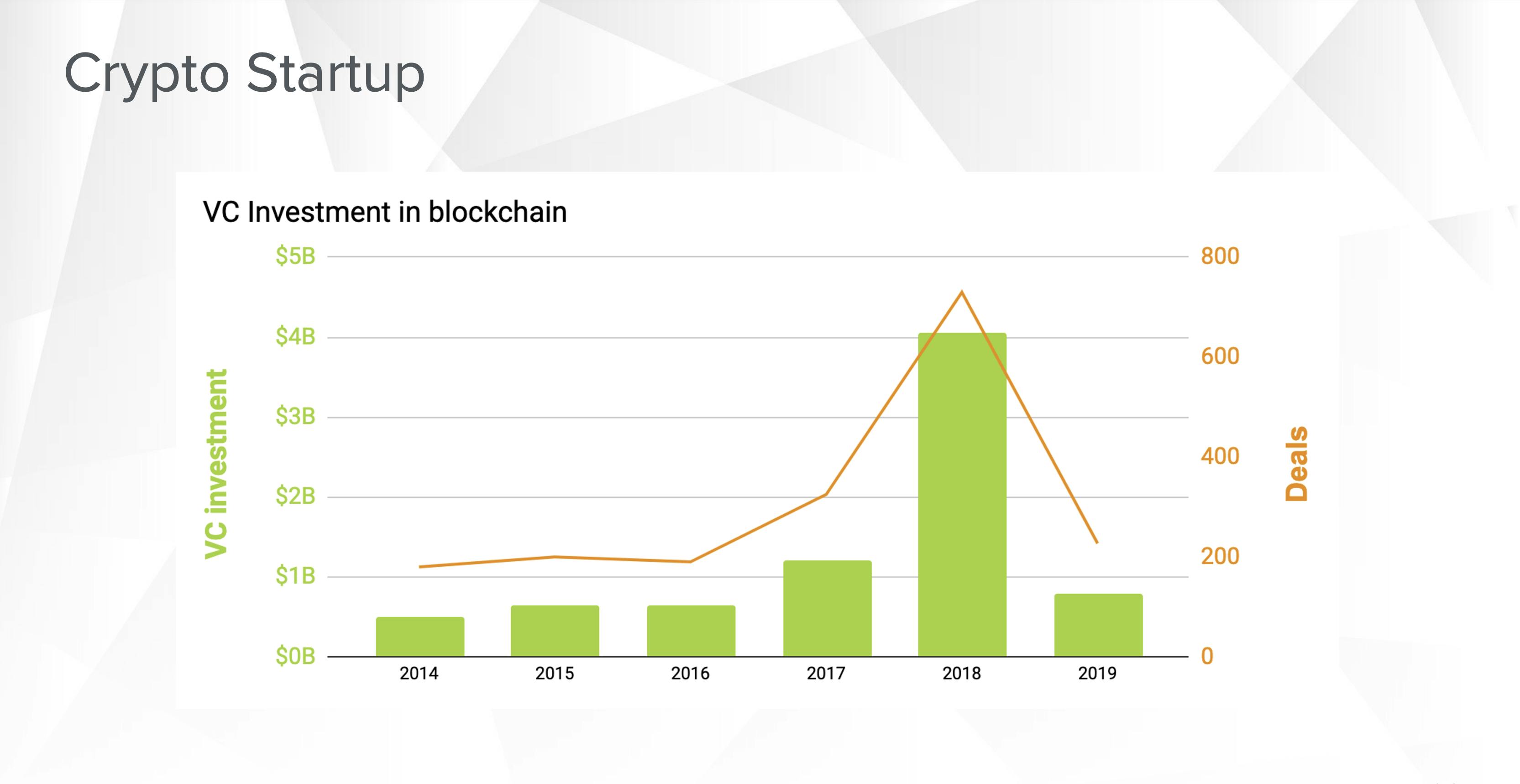

2017 PHASE

In 2017 we saw a similar bubble just like the dot-com in 2001.

We're now at the very beginning of that phase of these really big most valuable companies in the world

-they're gonna be built on this new decentralized protocol.

WHAT IS CRYPTO STARTUP?

Any startup that uses crypto to -

- Raise Money

- Acquire Customers

- Expand Internationally

ADVANTAGES

RAISING MONEY

It's hard to raise money even in silicon valley for startups which are based early in technology or are contrarian in nature

but crypto globalizes and democratizes the fundraising

ACQUIRING CUSTOMERS

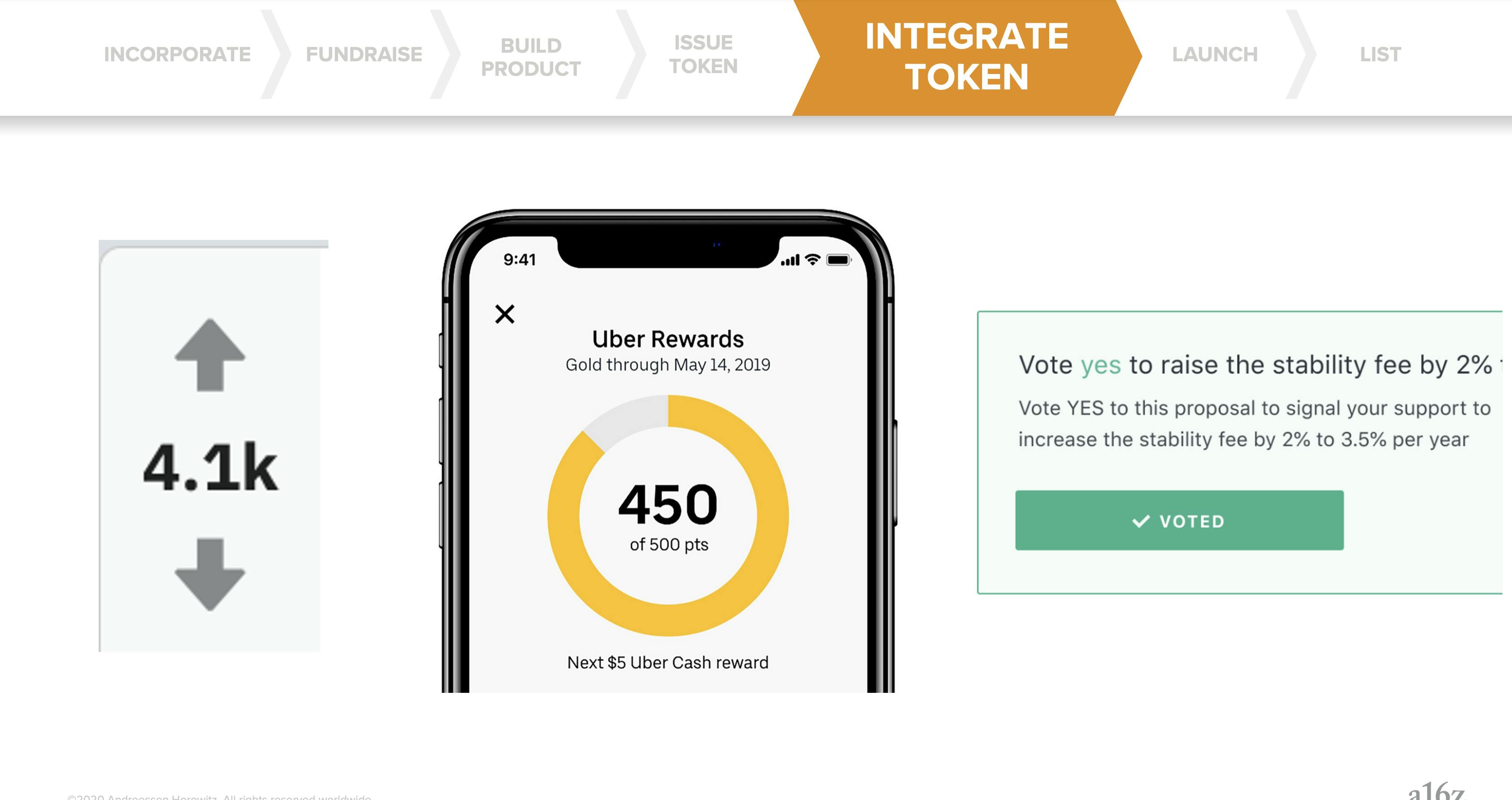

give incentives to early adopters (not just employees)

give a part of ownership in the company

participation incentives —> seed network effects

EXPAND INTERNATIONALLY

Avoid costly and difficult payment integrations one country at a time

Crypto enables a global user base from day one

DISADVANTAGES

LACK OF LEGAL CLARITY

NASCENT DEVELOPER TOOLS

FUNDRAISING OPTIONS

ICOs (Initial Coin Offering):

A method of raising capital wherein companies sell investors a new digital token or cryptocurrency.

IEOs (Initial Exchange Offering):

Fundraising event that is administered by an exchange platform.

Users can purchase tokens with funds directly from their own exchange wallet.

SAFT (Simple Agreement for Future Tokens):

It is a document issued for the future transfer of digital tokens from cryptocurrency developers to investors in exchange for raising funds now.

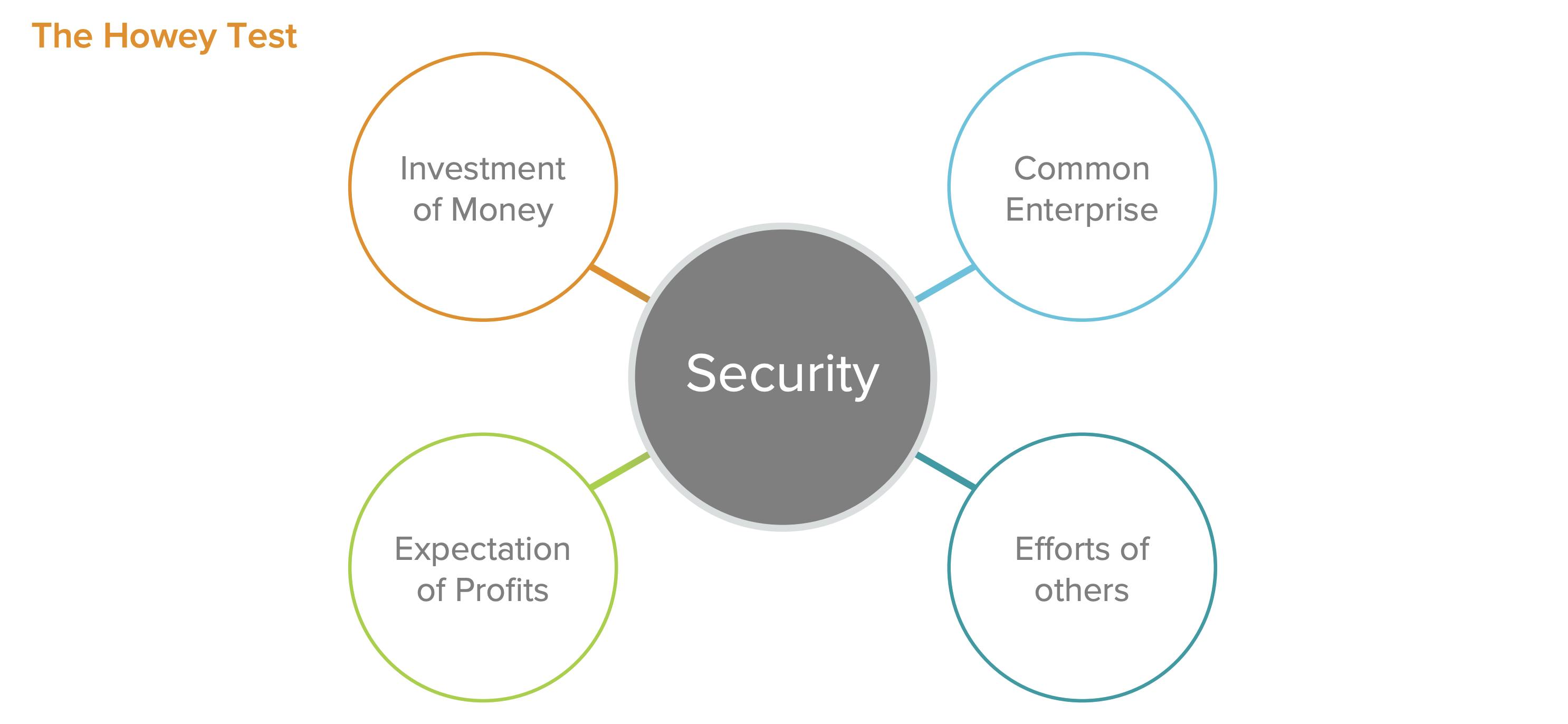

Howey Test:

The most important regulatory hurdle that a new crypto venture must pass is the Howey Test.

States that an investment contract exists if there is an "investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others."

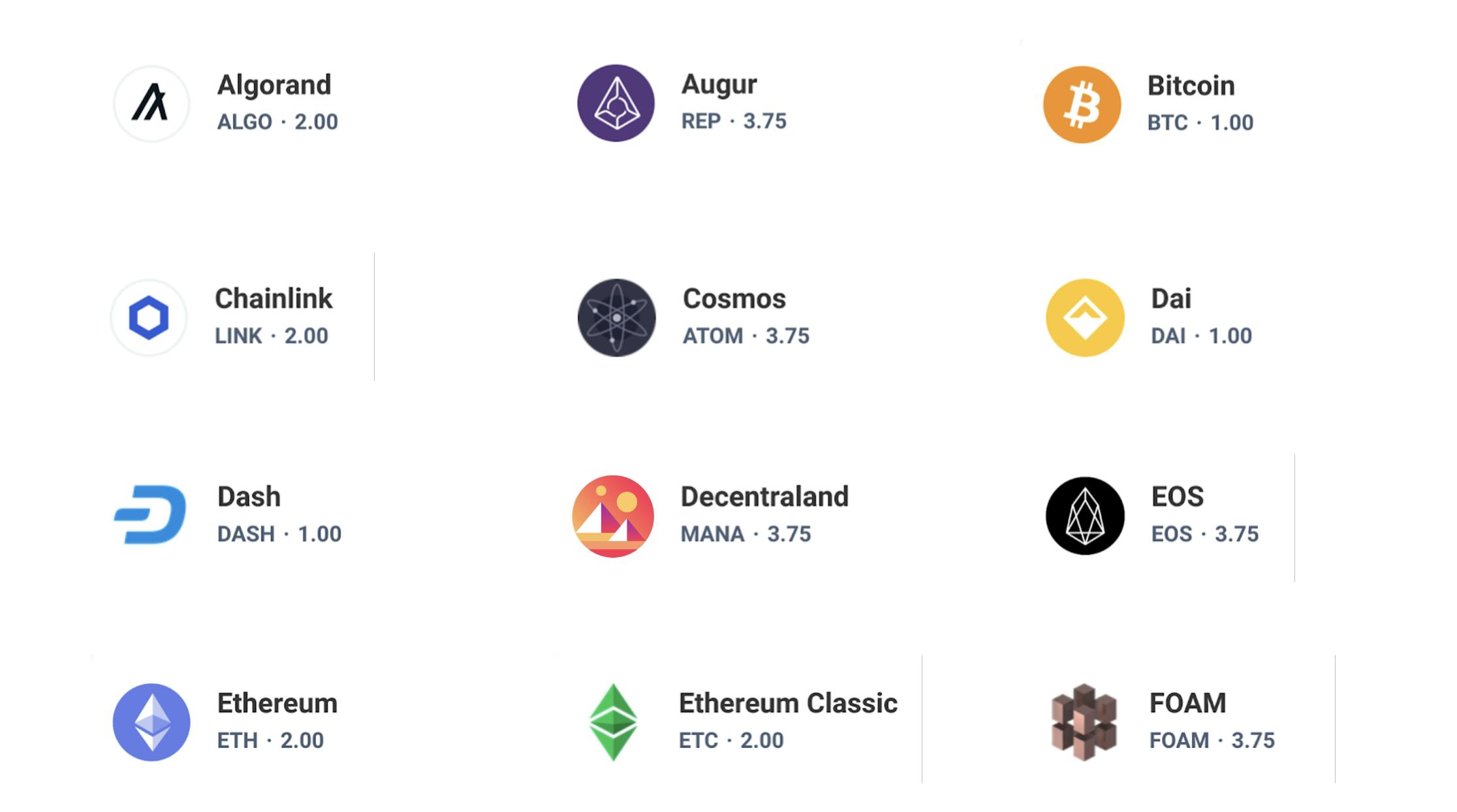

Crypto Rating Council

A framework to objectively assess whether any given crypto asset has characteristics that make it more or less likely to be classified as a security under the U.S. federal securities laws.

The analytical framework results in a score between 1 and 5 for each asset they review.

Score 1: Less/No Secure. Not a security under the U.S. federal securities laws.

Score 5: Highly Secure. Strongly consistent with treatment as a security.

7 STEP FRAMEWORK TO CREATE A CRYPTO STARTUP:

1) INCORPORATE using Stripe Atlas: Helps entrepreneurs set up their company in a reliable, safe, and fast way, from anywhere in the world.

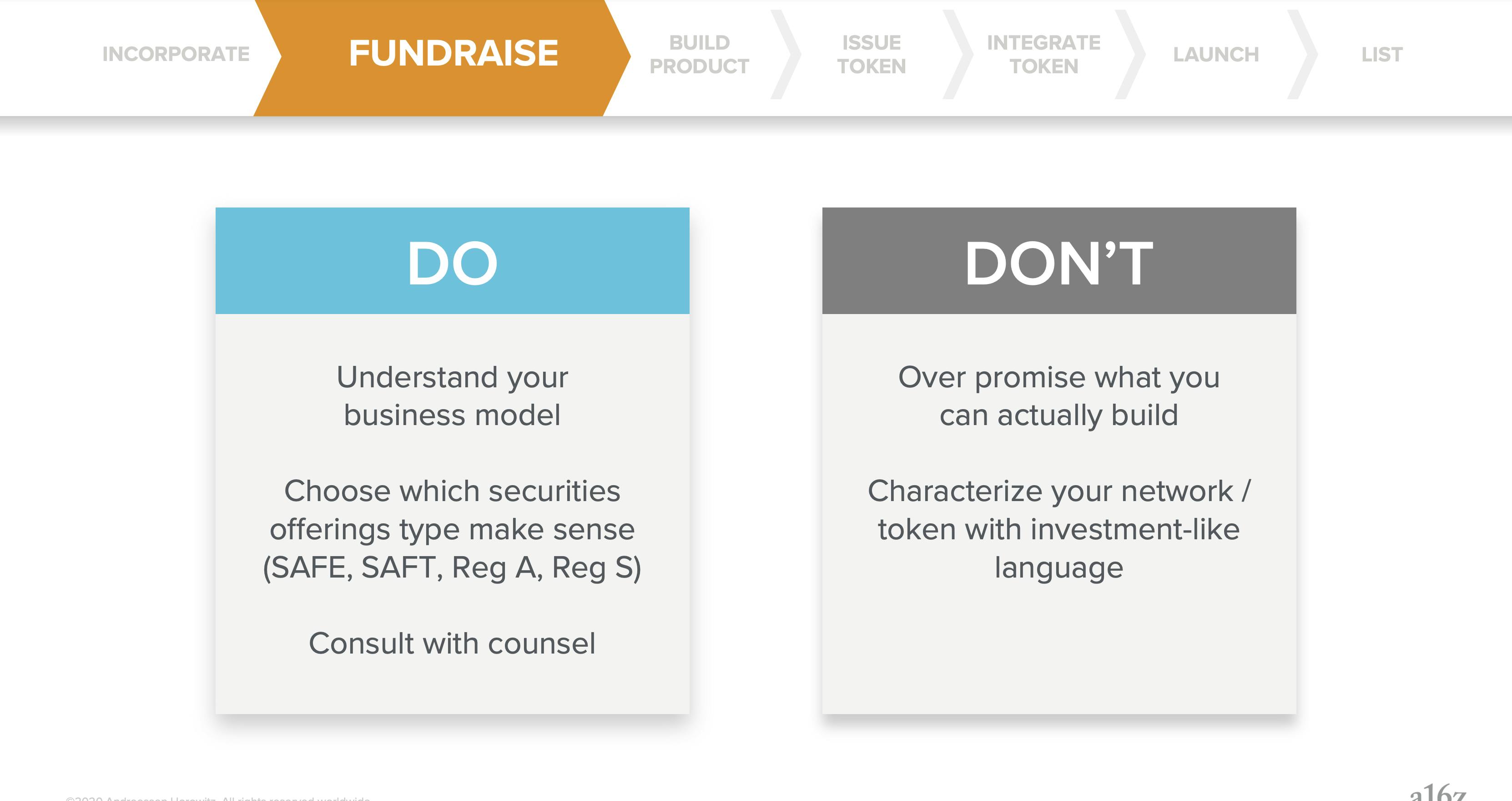

2) Do FUNDRAISE by understanding your business model and the type of security it offers (SAFT, IEOs, Reg A, Reg D).

3) BUILD A PRODUCT that the market really wants.

4) ISSUE A TOKEN using ARAGON by creating ERC20 and then submitting it to CRCs for security scores.

5) INTEGRATE TOKEN into your app/platform to incentivise the early customers of your startup by giving them ownership.

6) LAUNCH

Once the product is delivering the value it promised to the market and people are earning off your token, then.

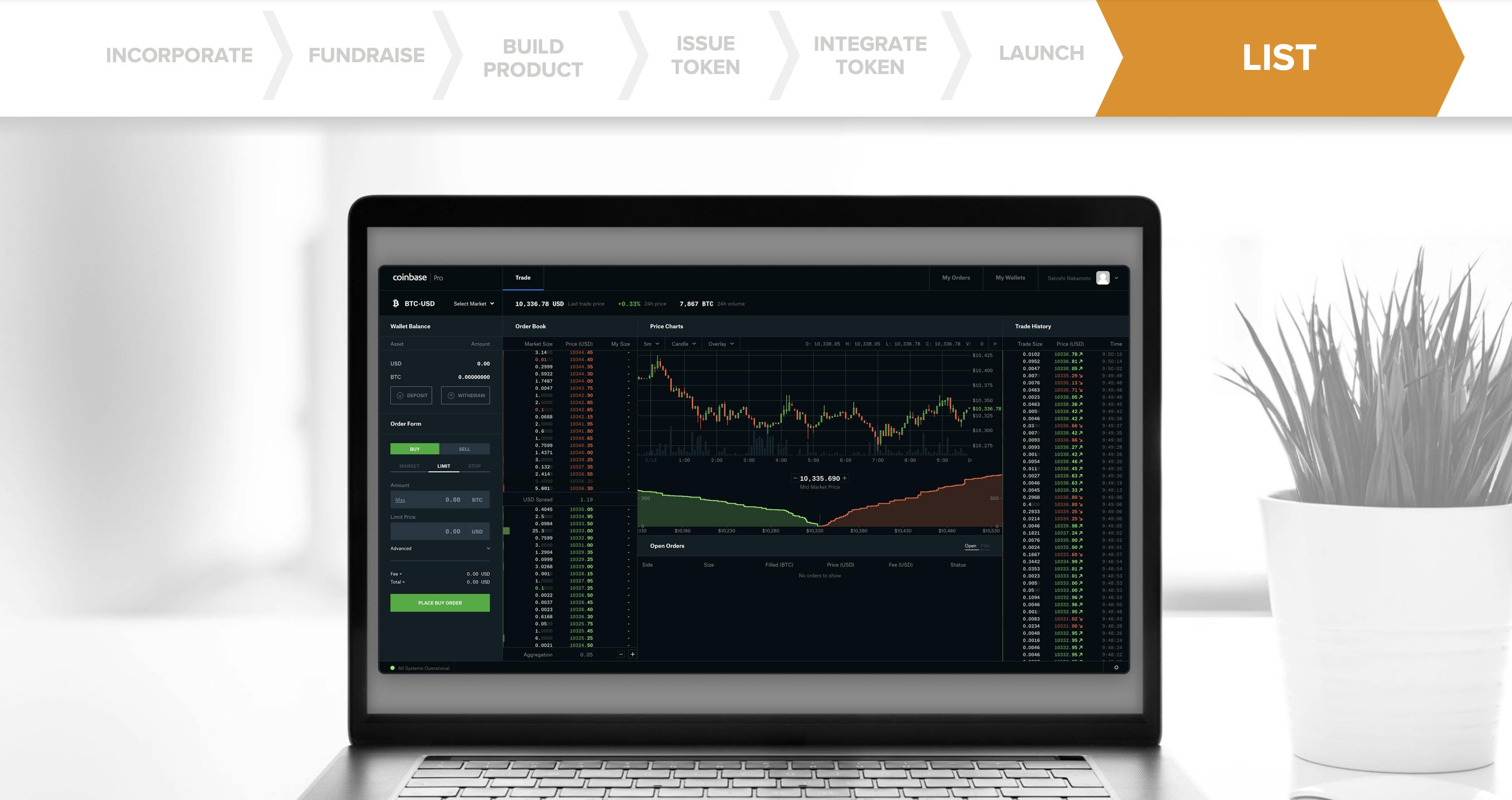

7) LIST the token on the exchange platform like Coinbase etc. making it available to the people/traders to buy and take part in the success of the company.

"IN 5-10YEARS EVERY STARTUP WILL HAVE INTERNET, AI AND CRYPTOCURRENCY SOMEWHERE IN THEIR PRODUCT" ~ @brian_armstrong

These are the condensed notes from 20 mins long Brian Armstrong's lecture on BUILDING CRYPTO COMPANIES.